Focusing on providing support to SME businesses within Surrey and the surrounding area

PROUD PARTNERS OF WOKING FOOTBALL CLUB –

2024/2025 SEASON

For over 40 years, Ashfield Accountancy has utilised cutting edge technology to provide accountancy services, and continues to seek out the most efficient ways of delivering services to clients.

By embracing the latest technology, we are able to advise the best way of obtaining the financial information you need to run your business whilst making sure you also operate as tax efficiently as possible.

We constantly strive to ensure fees remain competitive whilst making sure our services are delivered by a team of experienced and dedicated professionals.

As an established local practice, we offer support for individuals and all types of businesses needing advice about Accounting in Woking.

We recognise that no two clients have the same needs, and when it comes to providing Accounting services for you or your business, we are happy to tailor our service to suit your needs.

We have worked with many satisfied clients throughout Surrey who have benefited from our extensive experience, and we generally exceed expectations, often saving money for individuals and businesses in the course of our work.

With a keen desire to get to know our clients, we invite you to call for a free and informal discussion. You may just find our approach a refreshing change to you what you were expecting.

For over 40 years, Ashfield Accountancy has utilised cutting edge technology to provide accountancy services, and continues to seek out the most efficient ways of delivering services to clients.

By embracing the latest technology, we are able to advise the best way of obtaining the financial information you need to run your business whilst making sure you also operate as tax efficiently as possible.

We constantly strive to ensure fees remain competitive whilst making sure our services are delivered by a team of experienced and dedicated professionals.

As an established local practice, we offer support for individuals and all types of businesses needing advice about Accounting in Woking.

We recognise that no two clients have the same needs, and when it comes to providing Accounting services for you or your business, we are happy to tailor our service to suit your needs.

We have worked with many satisfied clients throughout Surrey who have benefited from our extensive experience, and we generally exceed expectations, often saving money for individuals and businesses in the course of our work.

With a keen desire to get to know our clients, we invite you to call for a free and informal discussion. You may just find our approach a refreshing change to you what you were expecting.

Our aim is to provide a ‘one-stop shop’ for all your accountancy solutions to enable you to concentrate on running your business.

We are an accountancy business committed to new technology that will enhance our services, reduce your fees, and give you greater flexibility and availability to information about your business.

Feel free to call and discuss your accounting requirements with no obligation and also take advantage of a FREE INITIAL CONSULTATION.

We think you will be pleasantly surprised!

We are a Xero Champion Partner, Quickbooks Platinum Certified Partner & a TAS Accounting Software business partner. We also have experience in a wide range of other accountancy software packages for desktop and cloud. You can be sure that whatever software package you have we will be able to assist you.

Our cloud based payroll service can provide payroll information direct to any PC within minutes of being processed by our experienced payroll staff or, if you prefer you can subscribe to use the payroll portal on self-serve basis.

A Cloud bookkeeping services

Cloud Advantage are bookkeepers for sole-traders, partnerships, and SME Limited Companies. Using the latest cloud platforms to provide access to your bookkeeping records, offering expert knowledge in a wide range of software, cutting edge , and up to date knowledge of latest VAT changes and Making Tax Digital compliance.

Outsourced Online Payroll Services & RTI Payroll Software

NetPayroll is an online payroll service that is second to none, delivering precise, professional and tailor-made RTI compliant payroll services whilst being simple to use and competitively priced. We provide an online payroll service that is straight forward and can be run by you, with pricing that eliminates any hidden and often expensive extras. We offer a client operated and/or a bureau operated RTI payroll solution putting our service way above other outsourced payroll service providers.

Run your entire small business better and faster with Xero accounting software.

Beautiful cloud-based accounting software which connects people with the right numbers anytime, anywhere, on any device. For accountants and bookkeepers, Xero helps build a trusted relationship with small business clients through online collaboration. Helping over 700,000 subscribers worldwide transform the way they do business.

Accounting software that helps you create custom invoices, manage VAT and see your data in real time

An accounting software package developed and marketed by Intuit. QuickBooks products are geared mainly toward small and medium-sized businesses and offer on-premises accounting applications as well as cloud based versions that accept business payments, manage and pay bills, and payroll functions.

No more data entry!

Dext (formerly Receipt Bank) helps small to medium-sized businesses, sole traders, and individuals save valuable hours by pulling information from receipts and invoices quickly, accurately, and efficiently.

Smart, Accurate, Automated Accounting

AutoEntry automates data entry by accurately capturing, analysing and posting all of your invoices, receipts & statements into your accounting solution.

Business Advice Lines

We have partnered with PFP to offer our clients a Tax Enquiry Protection service, as well as free access to their Legal Support and Advice Lines. PFP employ specialists with extensive knowledge and practical experience to offer up-to-date, solution based, advice and guidance on UK Law covering:

• Commercial litigation and dispute resolution • Property and landlord/tenant queries • Employment contracts/restrictive covenants, • Employment contracts/restrictive covenants • Disciplinary/grievance issues and unfair dismissal • Pensions • Health and safety • HMRC ‘unannounced’ visits

Lines are accessible to those subscribed to the Tax Enquiry Protection service 24/7, 365 days a year. Speak to the Ashfield team today for information & access details.

A cloud-based document portal with a difference

The Virtual Cabinet Document Portal is our ‘virtual letterbox’ – a highly secure method of communicating with our clients. The portal allows us to store, send, and receive documents, with legally binding digital signatures for turnaround times in hours.

If you need advice on any aspect of your Accounting in Woking, call Ashfield Accountancy for an informal discussion and we will be pleased to talk to you without obligation. We are confident that you will find our high levels of service and professional standards to be a match for any other firm offering Accounting in Woking

![]() Ashfield Accountancy

Ashfield Accountancy

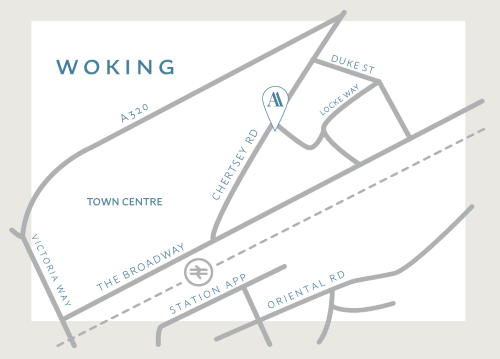

First Floor, 33 Chertsey Road

Woking, Surrey

GU21 5AJ

what3words location – ///motion.vibrate.stored